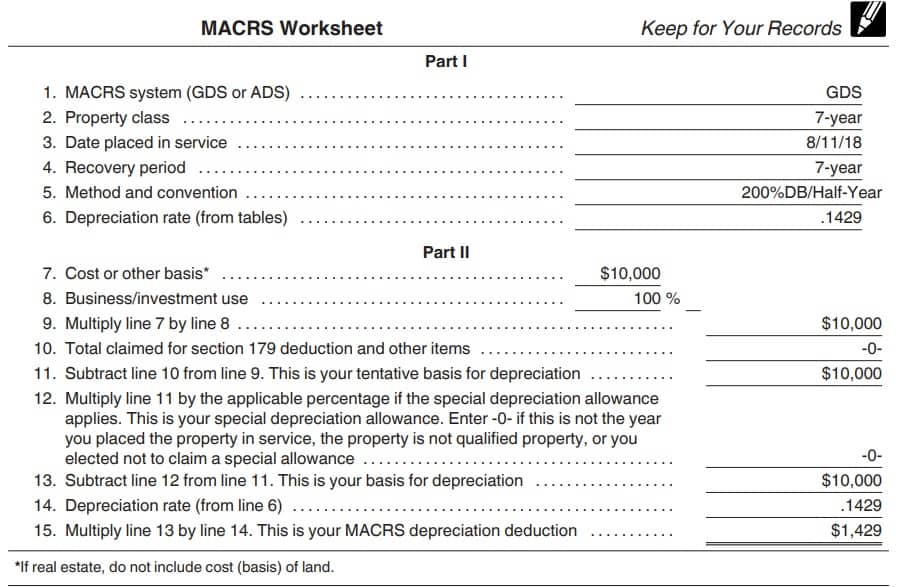

Office Furniture Depreciation Schedule

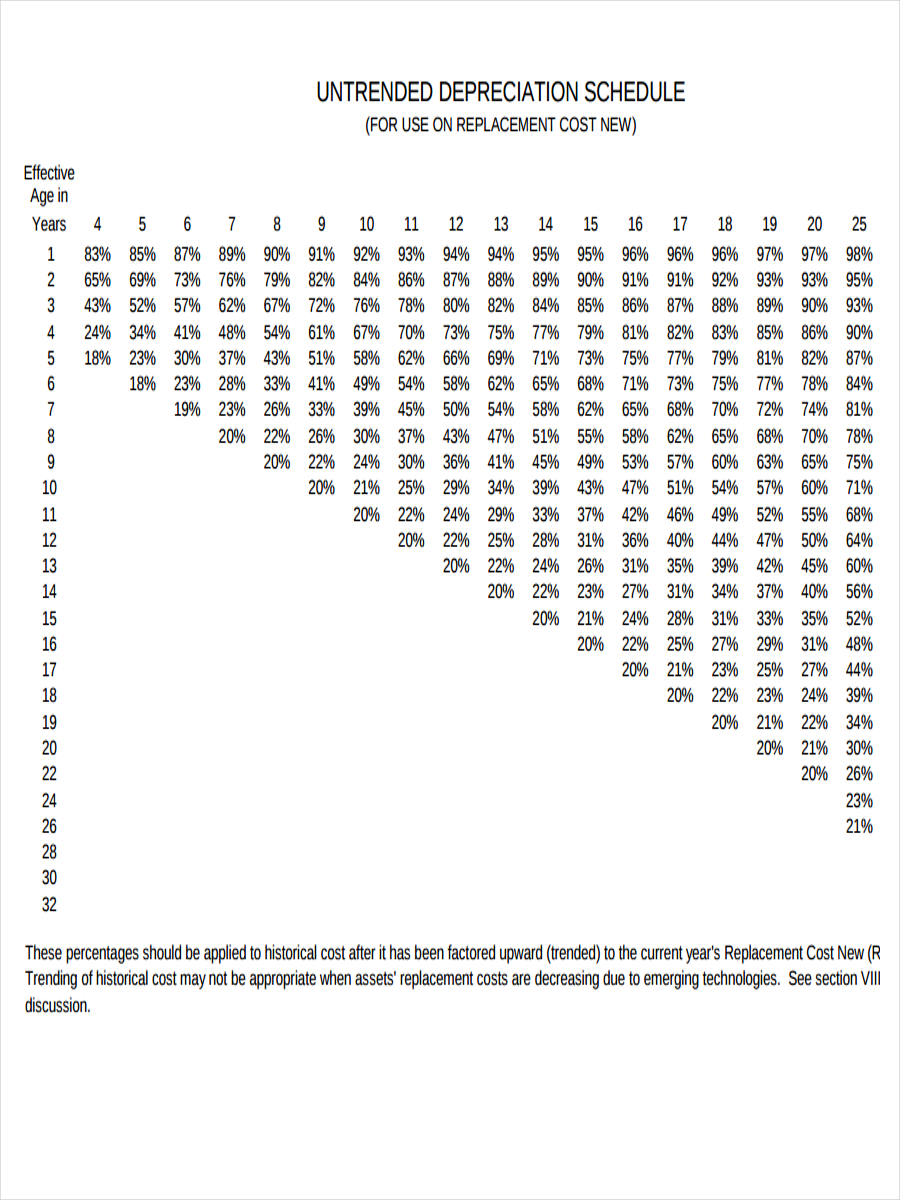

Office Furniture Depreciation Schedule. The first three years of MACRS depreciation deductions would be: Furniture Depreciation Calculator The Depreciation Guide document should be used as a general guide only; there are many variables which can affect an item's life expectancy that should be taken into consideration when determining actual cash value. Depreciation on any vehicle or other listed property, regardless of when it was placed in service.

If you use a capital asset, such as a car or machinery, in earning your income, you may be able to claim a deduction for the cost of that asset, spread over its effective life.

The basic formula, using straight line depreciation, is purchase price less salvage value divided by the total number of years of useful life.

This depreciation method divides the cost of the furniture purchase by the seven-year schedule, resulting in equal deductions each year. Seven-year property - appliances, office furniture,. A business fits out a new office, buying various pieces of furniture and office equipment.

Post a Comment for "Office Furniture Depreciation Schedule"